Exploring business ideas

Last year I read a series of book on personal finance, some of which made quite an impact on my life. Especially Rich Dad, Poor Dad and The Psychology of Money (also The Richest Man in Babylon, to some extent).

What I like about reading a suite of books on the same subject is that you get to see the important fundamentals repeated between them and it becomes easier to identify the less important fluff.

One such fundamental principle in these books was the difference between wealth and riches. Basically, rich people have a lot of money in their bank accounts, whereas wealthy people have assets continuously filling up their bank accounts. For me, this was more than semantics, as it changed my mindset around money.

It's less important how you have saved in your accounts or even how much you make in a year. What matters is how much your money grows, on its own, while you're asleep.

Another difference I learned was that between an asset and a liability. Purchases are one or the other but whereas liabilities only costs you money, assets also generates money.

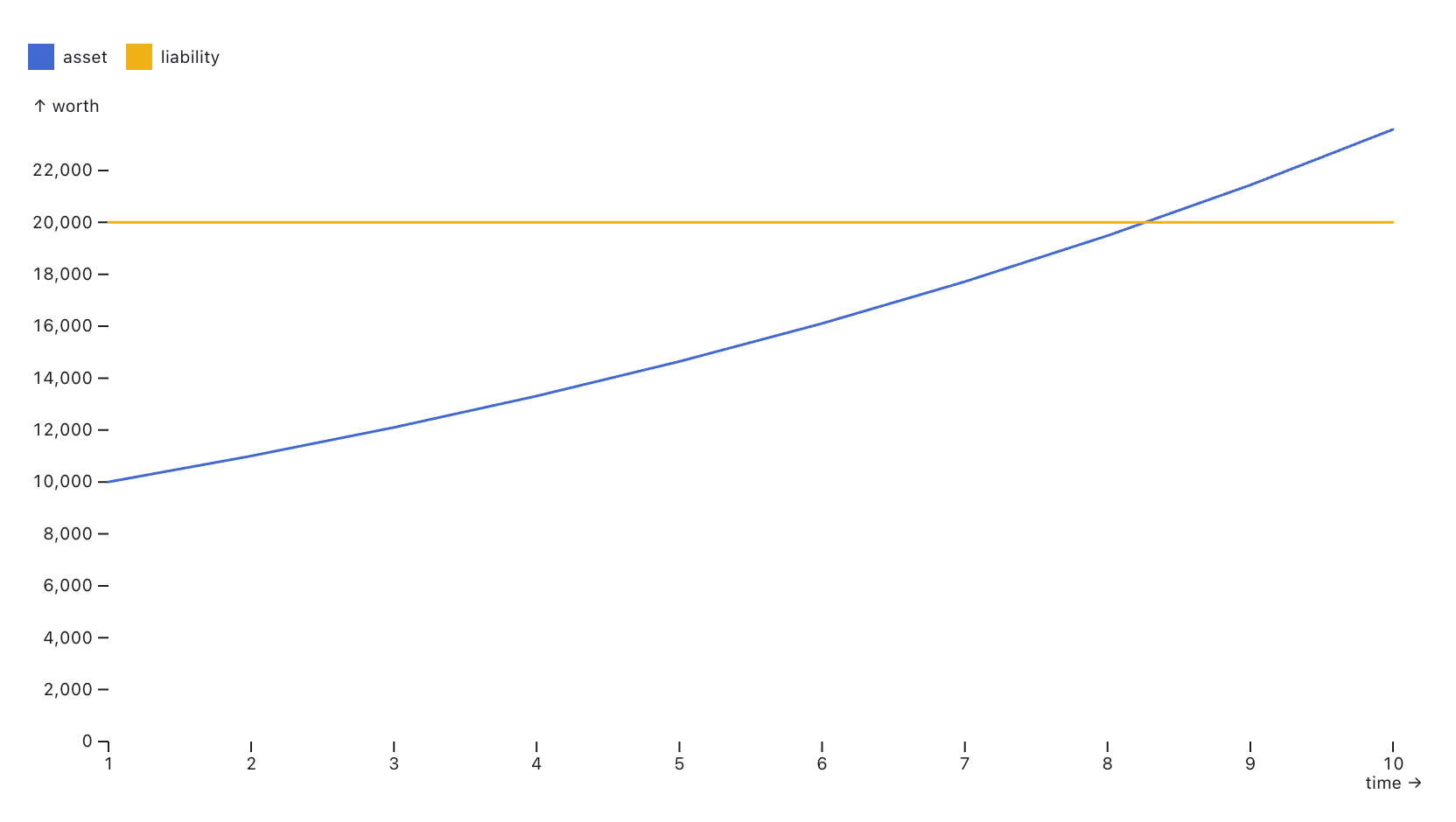

The difference? Let's look at a very realistic comparison over ten years, ten thousand in index funds versus double that in a bank account.

Ten years with assets vs liabilities

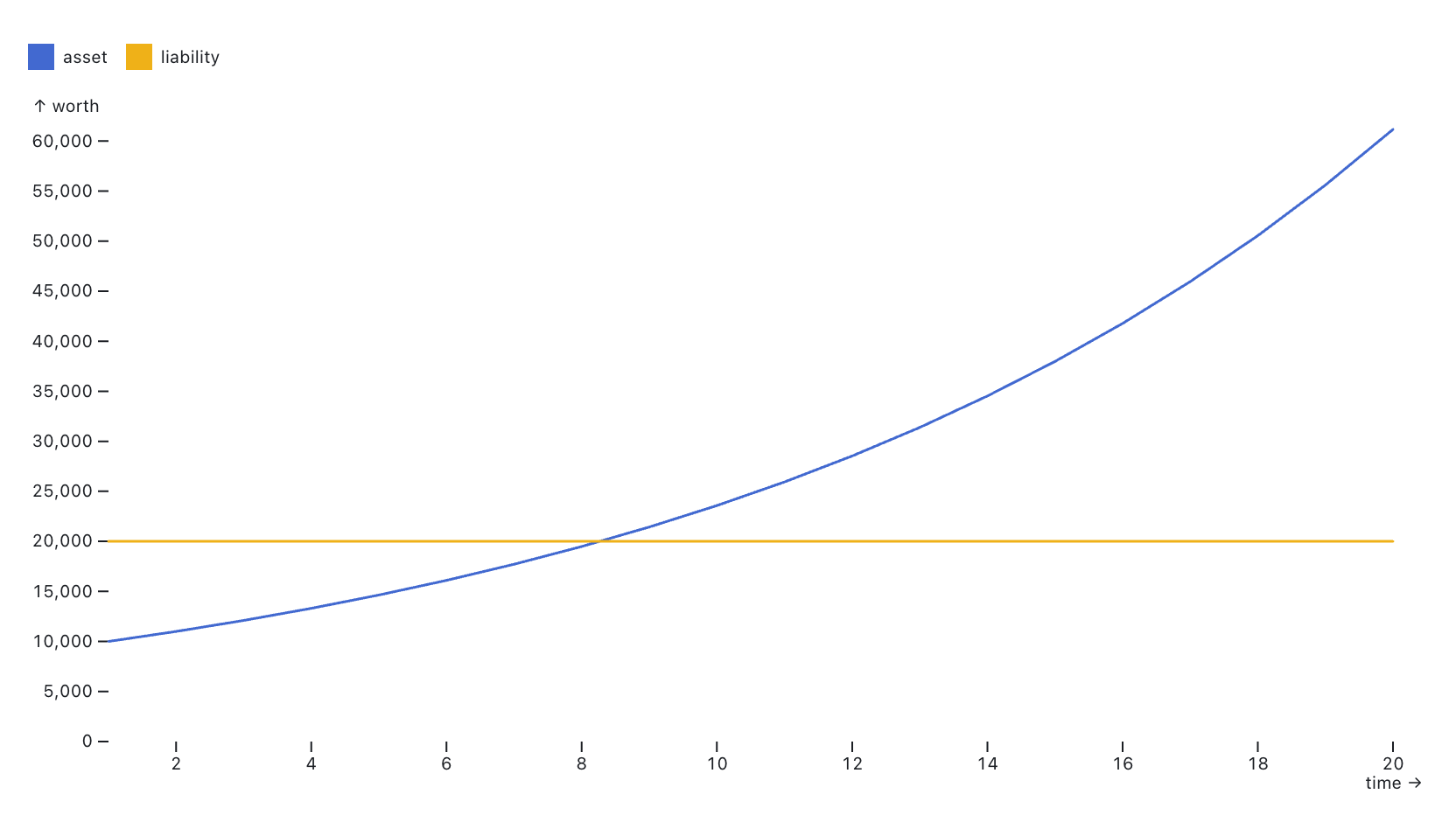

And if we crank that up to twenty years?

Twenty years with assets vs liabilities

You might have heard someone claim they "invested" in a pair of good headphones. It's a common misconception. Unless those magically yield dividends, it’s money spent on a liability, not an asset. Money that stopped generating more money.

It can still be a great purchase! But realizing this difference is key to effectively manage one’s finances.

The clock is ticking

Maybe it's my turning forty this year but I'm slowly starting to realize I'm not immortal. It's a sensation that is getting more real for every passing year. I have a finite amount of time left in this world, before it's time to step aside for future generations.

My own end is (hopefully) still many decades away but it no longer feels like it’s an infinite amount of time left, as I might have in my twenties.

That might sound dramatic and horribly bleak but it really isn’t. Realizing that life has an end infuses it with vitality. Shifting from a logical understanding of my own mortality to a deeper, more emotional one has only improved how I live my life.

This line of thinking has lately seen me asking myself what I want to achieve in life, what I actually want to do when I grow up, and what kind of legacy I want to leave behind.

Tell me, what is it you plan to do

with your one wild and precious life?

— Mary Oliver

I do have some ideas and I'm thankful to find myself in a position with more options than I could ever possibly exercise. In terms of building assets, I could go in a hundred different directions, which would all be plausible choices.

Whatever direction, however, the distance one is be able to cover is determined by how long they're able to consistently take one step after another. As The Slight Edge teaches, big changes comes from many small actions over a long period of time.

So if I want to become wealthy, for example, it’s high time to tie on my shoes and start walking.

Picking a path

While all roads lead to Rome, few other destinations enjoy the same luxury. If we want to go somewhere specific, we benefit from considering the path to get there.

At the end of 2022 I read Essentialism and it really hammered home the point of picking just ONE path. I have a natural tendency (pathology?) to walk all the paths, at the same time, not really getting anywhere, so this was an important lesson for me.

With this book, Greg McKeown expanded on Jeff Olson's point in The Slight Edge and declared that success comes from many small steps, consistently over time, in one direction at at time.

I deeply believe this to be a critical principle in life. So, for my wealth-building, I have to consider my options and pick only the very best one, throwing away a lot of really good ones.

Based on the frameworks and mental models taught in the personal finance books that started this article, there are three areas/levels of assets:

- salaries from jobs

- dividends from investments

- businesses

Deciding on the third, to build a business, was a no-brainer. It could have, by far, the greatest bang for my buck, and the other two already yield satisfying amounts.

However, I can’t build just any business.

As a father of two small children, a husband, and an executive position at work, I have a lot of responsibilities. Wanting to support all the people that depend on me, to the best of my abilities, there are a lot of demands on both my time and headspace.

So picking a business idea requires considering several criteria:

First — I have to be able to make progress with relatively little time. Spending another forty hours per week on top of everything isn’t feasible and would lead to not being able to perform in my existing roles — not an acceptable trade.

Second — Work must be able to be done sporadically, when gaps arise and I suddenly find myself with free time on my hands. Of course, I can squeeze out some planned time too, but having to constantly coordinate with partners or do recurring meetings won’t work.

Third — The business idea must have potential to grow into a generous asset. That’s kind of the core idea here, so I must be able to picture a future where the business overshadows wealth generated from salary and investments.

Fourth — The idea should be verifiable before too long, ideally with short feedback cycles along the way. It might not work, after all. The next one might not work neither. So I want to know whether it does as soon as possible, before wasting too much time.

Athlegan

After A LOT of consideration, over many months, I finally decided to proceed with Athlegan, my old online fitness coaching. It had been dormant since I got promoted to manager over two years ago and I was seriously itching to get back at it.

Athlegan is a very concrete business. I help people get strong and fit on a plant-based diet, to take control of their health and bodies, and to feel capable and awesome. Its purpose also aligns perfectly with my own ethics — a world without animal cruelty and needless suffering.

Another important factor for my decision was that Athlegan has an existing audience. Thousands of email subscribers, tens of thousands members in its Facebook group, and hundreds of previous customers. I would be able to get up and running in no time!

The plan was to restart by taking on a handfull of 1:1 clients and then build a more scalable suite of products from there. The coaching would generate some cashflow, which would let me hire freelancers to create products and run programs.

I thoroughly enjoyed creating content again, engaging the community, working with social media, and talking to all the cool people in this world. Being involved again in online marketing, content creation, and all things vegan fitness, was great!

Unfortunately, before long, it dawned on me that my assumptions were wrong.

There’s a famous marketing concept for audience relationship, where you want customers to Know, Like and Trust you, in order to make a sale (thus being able to make a difference in their life). While my audience did remember me (Know) and seemed excited for Athlegan to be back (Like), I really struggled to convince anyone to give me their business (Trust). Two years of radio silence had killed what I'd built.

I had also completed a round of some dozen customer interviews, which didn’t really confirm what I wanted, for the product ideas I had in mind. While I had previously proven that I could grow the 1:1 coaching to a decent level for a side project, that didn’t seem to translate to other products, that could be scaled.

Without an existing, trusting audience and an uncertain future potential, the selling points for Athlegan were very different from when I decided to pursue that for my business. So it was time to pivot and reconsider my options.

The merging of two worlds

On one hand, I really wanted to build my business in the fitness world but, on the other hand, I also wanted to leverage my decades of experience in the tech world. Surprisingly, these two worlds came to align in my next idea.

Last year, I began fiddling around with machine learning and I quickly fell in love with the discipline. It was a natural next step after years of fiddling with data mining and visualization. Things just fell into place!

I've also long been interested in artificial intelligence, having competed in Google AI challenge in 2010 and 2011, and implemented many different AI algorithms for MUD gaming (like path finding, pattern detection, diffusion).

This year I was planning on taking things further.

That's when I started talking to my brother, who owns two boutique gyms. They've been growing steadily for years but we wondered if they could grow even faster with the right kind of insights and specialized business intelligence.

My hypothesis is that they could. :)

We're already deep in the weeds right now, digging through data, trying to understand trainee behaviour, and building very specific, custom machine learning-models.

If this works, if I'm able to help these gyms grow by using data science and artificial business intelligence, the same principles should be applicable to other gyms as well.

The idea is basically to help them help others and thereby improve many more people's fitness and wellbeing. All while building a very concrete business, that could be scaled and potentially generate some decent returns.

Win-win-win!

But first, of course, I have a set of hypotheses to prove: that I can build the tech, that it can help gyms grow, and that they are willing to pay for it.

It's still early days and I'm still exploring possibilities, not wanting to get ahead of myself just yet. I'm having fun, learning A LOT, and the future potential is just a nice bonus at this stage.

If you're curious about my progress, subscribe (for free) and I'll keep you updated!